wave movie

Introduction and investment papers

I initiated a buy rating on Wix (Nasdaq: WIX) on February 16th.My optimistic thesis is based on my belief that by launching Rapidly innovate Wix Studio and its AI products while expanding profitability.The company has since released Financial Report for the Fourth Quarter of Fiscal Year 2023revenue and profits exceeded expectations.

In the fourth quarter, the company continued to adopt Wix Studio more deeply, with its partner business growing 38% year over year. At the same time, the company continues to innovate its artificial intelligence products. In the fourth quarter, it launched an artificial intelligence website generator designed to build instantly publishable websites based on user prompts. Meanwhile, management remains focused on improving margins.

Going forward, I believe Wix should continue to grow The company capitalizes on its growth momentum by attracting higher-intent users on its platform. This, in turn, will lead to higher conversion rates and monetization, leading to margin expansion. As a result, I raised my price target to $196, a 40% upside from current levels, and rated the stock a Buy.

About Vickers

Wix is a cloud-based web development platform that allows users to build websites and mobile applications without extensive coding skills using an easy-to-use drag-and-drop interface and customizable templates.

As of Q4 FY23, 73% of Wix’s revenue came from subscriptions, with the remaining 27% coming from commerce solutions, which includes e-commerce capabilities and booking systems. The company is focused on driving growth in two areas: 1) its partner business, which grew 38% year over year in the fourth quarter with the launch of Wix Studio; 2) artificial intelligence, where Wix is rapidly innovating and building new features to accelerate The growth of its Self Creator and partner businesses allows them to more easily create visual and written content and optimize web design to drive better business results.

Benefits: Continued business growth, rapid innovation and profit growth for partners

According to Wix’s fiscal 2023 fourth quarter financial report, its revenue was $1.56B, an annual increase of 13%. Of the $1.56B, creative subscription revenue contributed 73%, up 12% year over year, while business solutions contributed 27% of total revenue, up 20% year over year.

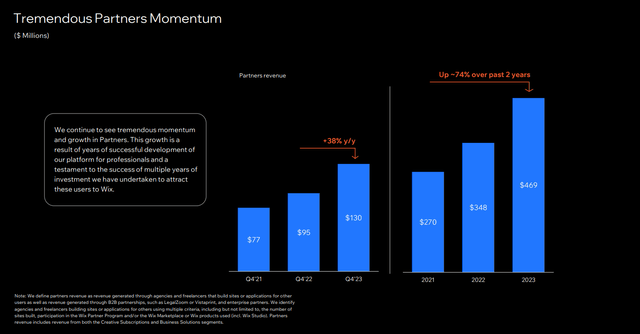

In my previous article, I talked about the promising partner business, which Wix describes as “income generated through agencies and freelancers who build websites or apps for other users, and through LegalZoom or Revenue generated from B2B partnerships such as Vistaprint, as well as enterprise partners.” Management outlined in its report one of the company’s strategic growth drivers. Investor Day Speechthis segment increased by 38% year-on-year to US$130 million in the fourth quarter, with a quarter-on-quarter growth of 9%.

Profit decline in Q4 FY23: Wix partners continue to gain momentum

During this period Earnings Conference Call, management is very optimistic about the progress they are making by adopting Wix Studio and the capabilities it provides in optimizing their partners’ workflow and productivity while improving their own customer service. That’s what Wix CEO Avishai Abrahami said during the earnings call, which speaks to the success of Wix Studio and its strategic moves to date around its partner business.

“Since August, more than 500,000 agencies and freelancers have created Studio accounts, and we now have more Studio Premium subscriptions than we expected. This growth is driven by our continued commitment to building a studio specifically for agencies and freelancers Driven by incredible progress in best-in-class products tailored for the freelance worker market. We have no plans to slow down. There are many improvements and exciting new tools for partners. We anticipate Studio and our broader specialty offerings will be meaningful catalysts for growth in the coming years.”

Looking forward, I stand by my thesis that I believe Wix Studio will drive accelerated growth in the Wix Partner business as Studio’s product innovations and enhancements will continue to bring in new customers and drive deeper monetization and Groups on the Gross Payment Volume (GPV) platform.

At the same time, Wix is committed to driving rapid innovation in artificial intelligence capabilities by building solutions that help customers create visual and written content, optimize design, write code, and drive better business results. In my previous article, I talked about Wix’s AI solution offerings, which include the AI Meta Tag Creator (designed to help generate optimized title tags and meta descriptions) and the AI Chat Experience (designed to generate recommendations across the web) Templates, business applications, and other business needs. In the fourth quarter, the company also launched an AI website generator that will create an instantly publishable website based on user prompts. During the earnings call, Avishai Abrahami mentioned that most of their new customers are using at least one AI tool on the platform and the engagement is encouraging. In my opinion, the company is heading in the right direction with its focus on artificial intelligence as a growth driver, as I believe the innovation pipeline will deliver a superior customer experience, leading to increased customer engagement and adoption. This, in turn, should lead to higher monetization rates, which will help the company unlock operating leverage to continue expanding profitability. That’s what Avishai Abrahami said on an earnings call, underscoring the optimism surrounding the company’s artificial intelligence efforts so far.

“We expect our AI technology to be an important driver of growth in 2024 and beyond. We also use AI to improve many of Wix’s internal processes, especially the speed of development. With these platforms, we can develop efficiently and at scale and releasing high-quality AI-based features and tools. We expect AI to continue to be our primary competitive advantage as we build our product suite and more AI tools to make users’ web creation experiences smoother , and help improve operations.”

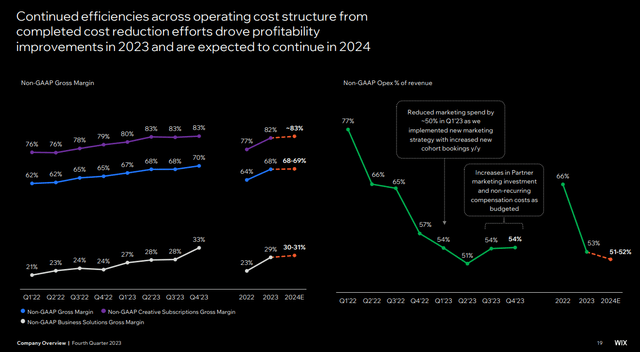

Turning to profitability, Wix achieved non-GAAP operating income of $240 million in fiscal 2023, a significant improvement from the $36 million loss in fiscal 2022. Non-GAAP operating margin expanded from -3% in fiscal 2022 to 15% in fiscal 2023. The company achieved this by streamlining operating expenses, particularly sales and marketing expenses, which accounted for 25% of total revenue in fiscal 2023, compared with 28% of total revenue in fiscal 2022. At the same time, I believe that as the company continues to drive its strategic initiatives to attract high-intent users as well as product innovation, it will drive higher conversion rates and monetization, thereby increasing average revenue per subscription (ARPS), which will convert To improve return on investment (ROI) on sales and marketing spend and improve operating leverage.

Profitability declines in Q4FY23: Wix’s profitability continues to improve

Looking forward, Wix expects revenue in FY24 to be in the range of $1.73-1.76B, with a growth rate of 11-13%. At the same time, the company expects non-GAAP gross profit margin to be 68-69%, and non-GAAP operating expenses to account for 51-52% of total revenue. This would represent non-GAAP operating income of approximately $315 million, an annual growth rate of 31%, and a margin of 18%, a 300 basis point improvement over fiscal 2023.

The Bad: Higher prices amid an uncertain macroeconomic environment

In my previous article, I outlined the risks facing Wix, especially as macroeconomic conditions remain uncertain and competitive threats from Shopify (NYSE:SHOP) and Squarespace (NYSE:SQSP) remain. The longer interest rates remain high, the more difficult it will be for small and medium-sized enterprises as borrowing costs remain at elevated levels. This could limit their spending power, which is a headwind for Wix’s growth prospects. At the same time, the competitive landscape forces Wix to continue investing in R&D to maintain a competitive advantage.

At the same time, the company has also implemented a new pricing model that will apply to all new and existing subscriptions. While management is confident in its decision based on past success with price increases, I am cautious as we may see some customer churn and a resulting decline in net retention, especially as macroeconomic conditions remain uncertain Under certain circumstances.

Combined: Wix is worth buying

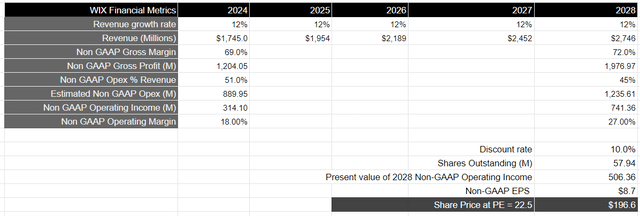

Assuming Wix grows revenue at 12% per year over the next 5 years (until fiscal 2028), it should be able to generate $1.98B in revenue. This will happen as long as management continues to drive growth in its partner business while improving customer engagement and profitability by building AI capabilities into its platform.

At the same time, I believe that if Wix continues to attract higher-intent users on its platform, it should lead to higher conversion rates as it continues to drive better business outcomes for them, which in turn will improve Wix’s overall profitability. At the investor day, management outlined its long-term financial model for non-GAAP operating expenses, which will slow to 51-52% in fiscal 2024, followed by 47.5% in fiscal 2025 and below 45% thereafter. Assuming Wix’s non-GAAP gross margin improves from 68% to 72% during this period, its non-GAAP operating income should total $741 million in fiscal 2028, and its margins should improve to fiscal 2028 from an estimated 18% in fiscal 2024 27%. FY28. After discounting by 10%, the present value will reach US$506 million.

take S&P 500 Index as proxyWith its company’s earnings growing at an average of 8% over 10 years and a P/E multiple of 15-18, I think Wix should be trading at at least 1.5x that multiple, which would lead to a price target of $196, up 40% from current levels. %.

Author’s valuation model

in conclusion

While there are certain risk factors, such as uncertainty about the impact of the pricing model given the current state of the macroeconomic and competitive landscape, I believe Wix has executed extremely well on its growth momentum thus far while expanding profitability. good. Therefore, I see roughly 40% further upside from current levels and rate the stock a Buy.