SDI Productions

WTB Financial ( OTCPK:WTBFB ) stock has underperformed over the past year, losing about 15% of its value, as it, like many regional and community banks, was adversely affected by last year’s banking crisis. WTB’s performance deteriorated significantly It faced material deposit outflows in the first half of the year and has since stabilized. I do expect the bank to have another less profitable year in 2024, although we should see sequential improvement in fourth-quarter levels.

Seeking Alpha

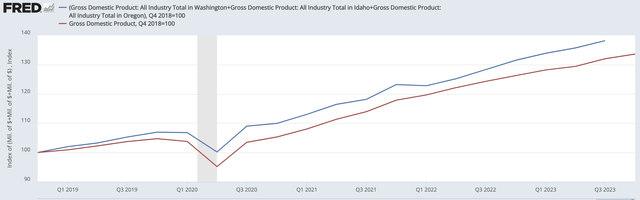

WTB Financial is the holding company of Washington Trust Bank. The agency has approximately $11 billion in assets and operates in Washington, Idaho and Oregon. It is essentially a large community/small regional bank. The economic conditions of the regions in which regional banks operate are clearly important to their financial performance.Although growth is not as fast as the Sun Belt, the region’s GDP is higher Growth is higher than the country as a whole, and I think that’s a positive.

Federal Reserve Bank of St. Louis

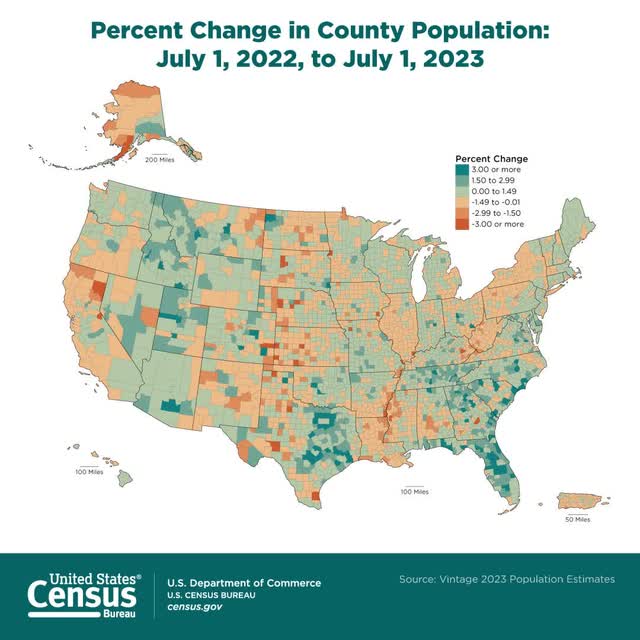

These states’ economies are driven by immigration california, although this pace has slowed since the post-COVID-19 peak in 2020-2021.In addition to rural Oregon, WTB’s core markets are seeing overall population growth. Washington’s economy is also a beneficiary of our growing tech industry, with Microsoft ( MSFT ) and Amazon ( AMZN ) both headquartered there.

Census Bureau

When it comes to WTB’s financial situation, 2023 is going to be a tough year.in the company Season 4, WTB earned $4.28. Currently, fourth-quarter profits are up 7% quarter-on-quarter, but down nearly 60% from last year. Full-year earnings per share fell to $22.29 from $45.28 in the same period last year. This resulted in a full-year ROE of just 6.35%. Like many regional banks, WTB’s net interest margin (NIM) is under pressure as rising interest rates from the Federal Reserve push up funding costs. Deposit flight after the collapse of Silicon Valley banks added to the pressure. This is the main reason why WTB’s position has been weakened.

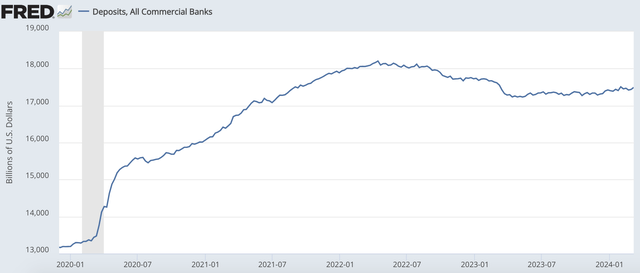

In fact, deposits fell 12% in 2023 to $8.1 billion. This is a poor performance given that deposits across the industry are down only 4% from their peak. WTB finds itself particularly vulnerable to deposit losses because of its large holdings of non-interest-bearing (NIB) deposits. In fact, NIB deposits fell by more than $900 million, or more than 20%, to $3.3 billion. Encouragingly, this decline slowed to just $107 million in the fourth quarter. Most NIB accounts are transaction accounts (i.e. salary accounts). When interest rates are near zero, it costs little to hold excess cash in NIBs, but as interest rates rise, there is an incentive to buy CDs or Treasury bills to earn more than 5%.

This is happening across the industry, and WTB is particularly affected. Now, there’s also a functional bottom line to these accounts – after all, there need to be enough funds to cover ongoing transactions, such as salaries. With employee turnover slowing to below 3% in the fourth quarter, we’re likely getting close to that point. Simply put, in a 5+% world, consumers and businesses have 9 months to optimize their cash positions; what’s left is likely to be close to the minimum.

WTB performed better on interest-bearing deposits, which fell less than 5%, or $200 million, to $4.8 billion. Of course, keeping those savings comes at a cost. WTB’s current total deposit cost is 1.46%, which means the cost of interest-bearing deposits is 2.47%. This was up from 2.12% in the third quarter and more in line with peers. WTB’s cost of funds rose 181 basis points in 2023 to 2.1% compared with a year ago. Considering that federal funds exceeded 3.5% in the fourth quarter of 2022, WTB’s cost of funds of about 0.3% is very low, thanks to higher NIB balances and little pass-through of Fed rate hikes in interest-bearing accounts. This has pushed its net interest margin (NIM) to unsustainably high levels and its profits to enviable levels. Now, after a sharp increase in deposit rates, its funding costs are more normalized.

Encouragingly, these actions have stabilized the situation, although deposits are much lower than a year ago. Deposits increased by $236 million in the second half and increased 1%, or $77 million, to $8.1 billion in the fourth quarter. While we are seeing some unfavorable mix moves from NIB accounts to IB accounts, the fact that interest-bearing deposits are now increasing suggests that it has sufficiently increased interest rates. It’s also worth taking a step back and considering WTB’s long-term deposit performance.

At the end of 2019, the bank $5.6 billion in deposit. Since then, its deposits have increased by about 45%. In comparison, the growth rate of industrial deposits is about 33%. Although industry deposits are down only 4% from the peak (while WTB is down 12%), its deposit accumulation is still better than that of the entire industry. Combined with the stability in the second half, I think this points to flat or modest deposit growth in 2024.

Federal Reserve Bank of St. Louis

Now, as noted, higher funding costs compressed net interest margins. Net interest margin dropped 105 basis points from last year to 2.42%. Although financing costs rose by 180 basis points, its return on assets rose by only 62 basis points to 4.36%. The decrease in net interest margin compared to the fourth quarter of 2022 equates to quarterly headwinds of $23 million. This headwind is receding as deposits stabilize, with net interest margins falling just 9 basis points sequentially. Given asset growth, the impact on net interest income is now largely complete.

Interest income increased to $122 million from $97 million a year ago, but deposit and borrowing costs rose to $54.5 million from $7.1 million last year, resulting in a decline of about $23 million. Instead, financing costs increased sequentially by $8 million, which was essentially matched by a sequential increase in interest income of $8 million. Since increases in deposit costs are likely to become smaller, I expect the situation to improve as asset yields rise.

Even with a smaller deposit base, loans grew 7.7% year over year to $6.5 billion. The reason for this growth is that WTB’s loans will grow slower than deposits through 2022, a prudent move in case deposits leave the system. Loans grew approximately 44% compared to 2019, exactly in line with deposits. This leaves WTB with a loan-to-deposit ratio of 78%. Therefore, I expect loan growth to be similar to or slightly faster than deposit growth in 2024.

Loan quality is also quite strong. Provisions for the fourth quarter were $2.5 million, down from $4.4 million in the previous quarter and unchanged from the same period last year. WTB has set aside a loss reserve of 2.25%, or $146 million. This compares with the bank’s non-current loan ratio of 0.48%, or $32 million, and a 30-89 day delinquency rate of $9 million. This provides over 300% coverage for non-performing loans, which is above my “healthy” mark of 250%. Therefore, I believe reserves are adequate even with a slight increase in delinquencies and expect similar reserve levels in Q4 2024.

A significant headwind for WTB, like many banks, is that as deposits flow in it purchases fixed-income securities at much lower interest rates than currently. As deposit costs rise, this squeezes net interest margins. WTB has $3.6 billion in securities, essentially double the $1.9 billion in 2019. Now, as deposits begin to flow out, WTB is allowing the portfolio to shrink rather than continue to reinvest to maturity, which is why it is $200 million lower than a year ago. WTB has $1.3 billion of securities maturing within the next four years, and amortization payments on the mortgage portfolio. The portfolio’s fourth-quarter yield was only about 1.9%, so it was below WTB’s weighted average cost of funds.

At each maturity, WTB can be reinvested at a higher prevailing yield or repay the borrowed money, which I think is more likely. As deposits declined, WTB took out $1.9 billion in wholesale borrowing to ensure liquidity. Meanwhile, WTB is also holding more cash, rising to about $1 billion from $273 million a year ago. Total assets rose to $11.45 billion from $10.4 billion a year ago, even as deposits fell due to a surplus of cash.

With deposits currently stable, I expect WTB to gradually reduce its cash and borrowings, which will keep net interest income roughly neutral. However, this deleveraging will result in an increase in net interest income as securities with interest rates below 2% to maturity will repay debt that costs approximately 5%. Assuming a portfolio reduction of about $400 million this year, this repositioning would boost annualized returns by $3.60 by year-end, a tailwind that would continue into 2025, when deposits grow and WTB reduces its excess cash position. Eliminate wholesale business funding from its capital structure.

I would also point out that WTB is well capitalized. As of the end of 2022, the company’s Tier 1 risk capital ratio was 12.5% and its equity asset ratio was 8.3%. As of end-2023, the equity to assets ratio is 7.8%, so capital is down slightly, but by the time the audit results are released, tier one equity is likely to be well above 10%, which is a very healthy level for a bank the size of WTB. WTB’s $15 million buyback is due in March, and I don’t expect it to buy back shares at this time. WTB’s tangible book value of $355.53 is well below its share price; in part because most of its securities are classified as held to maturity, meaning they are held at amortized cost rather than at market levels , considering its yield and duration, the market level may be 8-10% lower. This will have an after-tax impact of approximately $200-250 million, or approximately $90 per share.

This implies that WTB has an “economic” book value of approximately $265, meaning the stock trades at approximately 1.06 times normalized book value, but well below stated book value. Importantly, WTB can hold these securities until maturity and they will gradually return to par value before maturity. But at the same time, they will continue to suppress Nanyang.

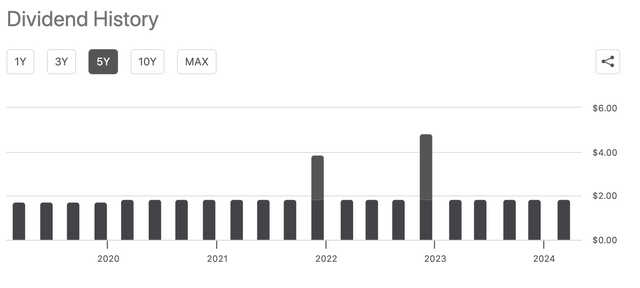

WTBFB pays special dividends when net interest margins are extremely high. Q4 2022, WTB declare For example, the special dividend is $3.00. I don’t expect special dividends over the next two years, but its underlying dividend is safe and yields 2.6%.

Seeking Alpha

Essentially, the $900 million in net borrowings to fund its securities portfolio equates to a pre-tax headwind of about $30 million, or more than $9 per share. Now, if the Fed cuts rates in 2024, that will reduce headwinds as floating borrowing costs fall. Assuming modest deposit and loan growth and controlled expenses, I expect operating earnings to be similar to Q4 levels or even slightly higher, with profitability around $17-$19. By the end of 2025, when wholesale financing is removed, operating margins will recover to $28-$30, assuming modest asset growth. I expect this to be $2-$3 in 2024, or about $20-$21 per share.

That puts the stock at a price-to-earnings ratio of 14 times 2024 earnings, which is somewhat expensive for a regional bank, but that’s mostly because portfolio/wholesale funding headwinds will fade with each maturity. Assuming a final forward multiple of 10-12x, the stock should be trading at around $325-350 by the end of 2025. The upside over the next 21 months is about 19%, with dividend payments of about 4% and annualized returns of about 12% through 2025.

Of course, all investments involve risks. For WTB, as with all regional banks, I will continue to monitor non-performing loans for potential credit degradation. Its strong reserve coverage does provide some protection here. Furthermore, if we see the Fed raise rates instead of cutting them, this will increase its funding costs and further reduce its net interest margin; I think a rate hike is unlikely. Additionally, I will continue to monitor deposits. A return to falling deposits appears unlikely, but would also put pressure on NIM as it will take longer to repay wholesale borrowings.

I would also point out that even after the wholesale funding has been paid off, WTB will still hold maturing securities at low interest rates that can be reinvested and help drive further earnings growth to levels above $28-30, although net Interest income growth will slow. With the opportunity for multi-year double-digit returns, WTB is an attractive investment opportunity in the regional banking sector and I think the stock is a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.