JHVE photos

In today’s very expensive stock market, investors demand outperformance to justify premium valuations; in the technology industry, layoffs and slowing sales have become the norm rather than the exception, and stock markets have been wildly volatile. Fourth quarter earnings season.

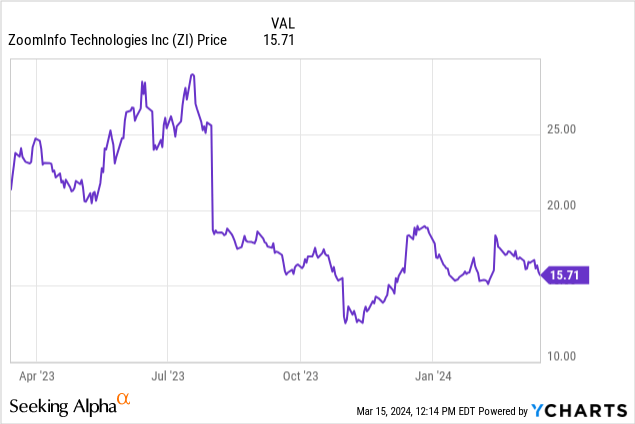

Zoom information (NASDAQ:ZI), a sales software platform that helps companies generate leads, has fallen more than 10% this year, even as the broader market has risen in almost the opposite direction. The question for investors now is: Does this name still have residual value?

Lowest growth forecast for fiscal 2024 heightens huge risk of growth star falling

The last time I wrote a bearish report on ZoomInfo was in December, when the stock was trading near $18 per share.ZoomInfo has since released dismal fourth-quarter results, showing Revenue continues to decelerate: It also shows that the growth path this year is very small. Even though the share price has declined slightly since the end of last year, ZoomInfo still isn’t enough to make it a stock worth taking on the extra risk.All in all, I still bearish here.

As a reminder to investors new to the name, here are ZoomInfo’s core red flags:

- Overexposure to the software industry. ZoomInfo’s core business is selling products to other software companies, making it more vulnerable to the current macroeconomic conditions that have put technology companies in trouble.

- The engine barely grows ZoomInfo expects only single-digit growth in fiscal 2024. After growing significantly during the epidemic, ZoomInfo’s growth has decelerated sharply, showing an unstable growth trend, while mature, high-quality software companies can manage a more stable growth model.

- Competition in CRM software is fierce. ZoomInfo is one of many CRM-style products competing with better-known names like Microsoft (MSFT) LinkedIn and Salesforce (CRM). These competitors also have the ability to cross-sell CRM solutions with other platform products, while ZoomInfo stands alone as its own solution. In an environment where many IT departments are trying to consolidate vendors and constrain budgets, this could hurt ZoomInfo more than it did in pre-pandemic times.

- The debt burden is large. Unlike many of its tech peers, ZoomInfo is in a net-debt position, and its floating debt structure exposes it to high interest costs.

- No progress in profitability: Despite the slowdown in growth, ZoomInfo hasn’t made much progress in shifting its focus toward improving operating margins — despite laying off about 120 employees in fiscal 2023.

From a valuation perspective: At its current share price of nearly $16, ZoomInfo has a market capitalization of $5.95 billion.The company’s final results are after we strip out the $529.3 million in cash and $1.23 billion in debt that ZoomInfo had on its most recent balance sheet The enterprise value is $6.65 billion.

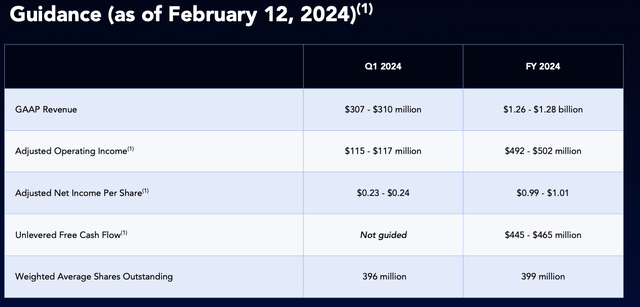

At the same time, for the upcoming fiscal year 2024, ZoomInfo expects revenue to be only US$126-1.28 billion, with annual growth of only 2-3%; the midpoint of earnings per share is expected to be US$1.00.

ZoomInfo Outlook (ZoomInfo fourth quarter financial report)

This gives ZoomInfo a valuation multiple of:

- 5.2x EV/FY24 revenue

- 15.7x FY24 P/E

Regardless, the valuation is certainly not high, but it’s not high enough to justify such poor fundamental performance. Avoid here and invest elsewhere.

Season 4 download

Now let’s take a closer look at ZoomInfo’s latest quarterly results. A summary of fourth-quarter earnings is as follows:

ZoomInfo Q4 results (ZoomInfo Outlook)

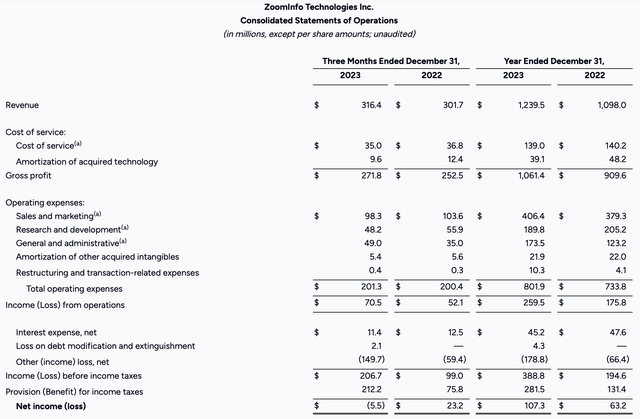

ZoomInfo’s revenue rose 5% year-over-year to $316.4 million, higher than Wall Street’s forecast of $310.5 million (up 3% year-over-year), but down from the 8% annual growth in the third quarter.

ZoomInfo’s growth has slowed in direct proportion to the challenges faced by the software industry, which is ZoomInfo’s largest sales division. Software companies spend a lot of operating expenses recruiting sales teams, who use CRM engines like ZoomInfo to chase leads. Silicon Valley’s austerity measures have slashed sales staff over the past year, creating a vicious cycle for ZoomInfo’s own sales. However, ZoomInfo leadership noted that non-software sales performed better. According to CEO Henry Schuck’s speech on the fourth-quarter earnings call:

Having said that, since the beginning of 2022, we have been dealing with the challenges of a soft macro environment, which has been particularly hard on our largest industry vertical, the software industry.

Overall, the software industry is shrinking while all other industries are growing. New business performed well, but NRR declined as the pullback in the software vertical disproportionately impacted our existing customer base, resulting in fewer upsells and more markdowns. However, our demand for new business and the pace of sales are the best ever. We closed our newest logo ever in Q4. Our month-to-month creation and closing win rates in December were our highest in a single month, and our median sales cycle was significantly shorter year over year. “

Notable: ZoomInfo Report Net revenue retention rate for fiscal year 2023 is 87%, showing that the company suffered more churn and markdowns/seat shrinkage than it achieved seat expansion and upgrades. This is rare in the software industry, where many software industries still have NRRs above 100% despite a tougher macro environment. Given that ZoomInfo itself invests in its sales team to close recurring revenue deals, it does rely on strong expansion trends to drive long-term operating leverage. The company’s fiscal 2024 guidance assumes no improvement in NRR trends this year; while the low end of the range assumes a decline.

Another red flag raised during CFO Cameron Hyzer’s presentation on the fourth-quarter earnings call: The company is facing collection issues in smaller areas of its business.

This part of our business grew by about 15% in the fourth quarter compared with last year. In the fourth quarter, charge-offs continued to impact us as many of our smallest customers continued to face affordability challenges. In addition to the increase in bad debt related to charge-offs, we experienced a revenue impact of similar magnitude. Our expectation is that the impact of charge-offs will diminish over time as our revenue mix continues to shift toward enterprise customers and as we roll out more product-led features (pay at checkout) for smaller customers . “

Declining expansion trends and deleveraging from poor sales also pushed ZoomInfo’s adjusted operating margin to 40%, down two percentage points from 42% in the fourth quarter of last year.

focus

ZoomInfo faces a very challenging environment as it enters fiscal 2024, with declining expansion trends, weakness in its all-important sales unit, and an accumulation of uncollectible receivables from small customers. Since there seems to be no light at the end of this tunnel, I still tend to stay away from this name.